A Scarcity-Driven Luxury Platform

Marco Gérard is structured as a private luxury IP house with a long-term vision focused on brand equity, controlled expansion, and intellectual property

monetization.

The house is not built on mass consumer reach.

It is built on high-margin, low-volume, high-control releases.

What Makes Marco Gérard Investable

- Registry-Based Model

- Every asset is authenticated, numbered, and traceable—creating defensible brand equity and collector confidence.

- Limited Allocation Strategy

- Products are pre-allocated and capped, supporting price discipline and resale integrity.

- Category Expansion Without Brand Dilution

- Watches, fragrance, leather goods, and accessories are introduced selectively, each under independent production caps.

- IP-Centric Structure

- Designs, trademarks, trade dress, and future licensing opportunities remain centrally controlled.

Current Status

- House established: 2001

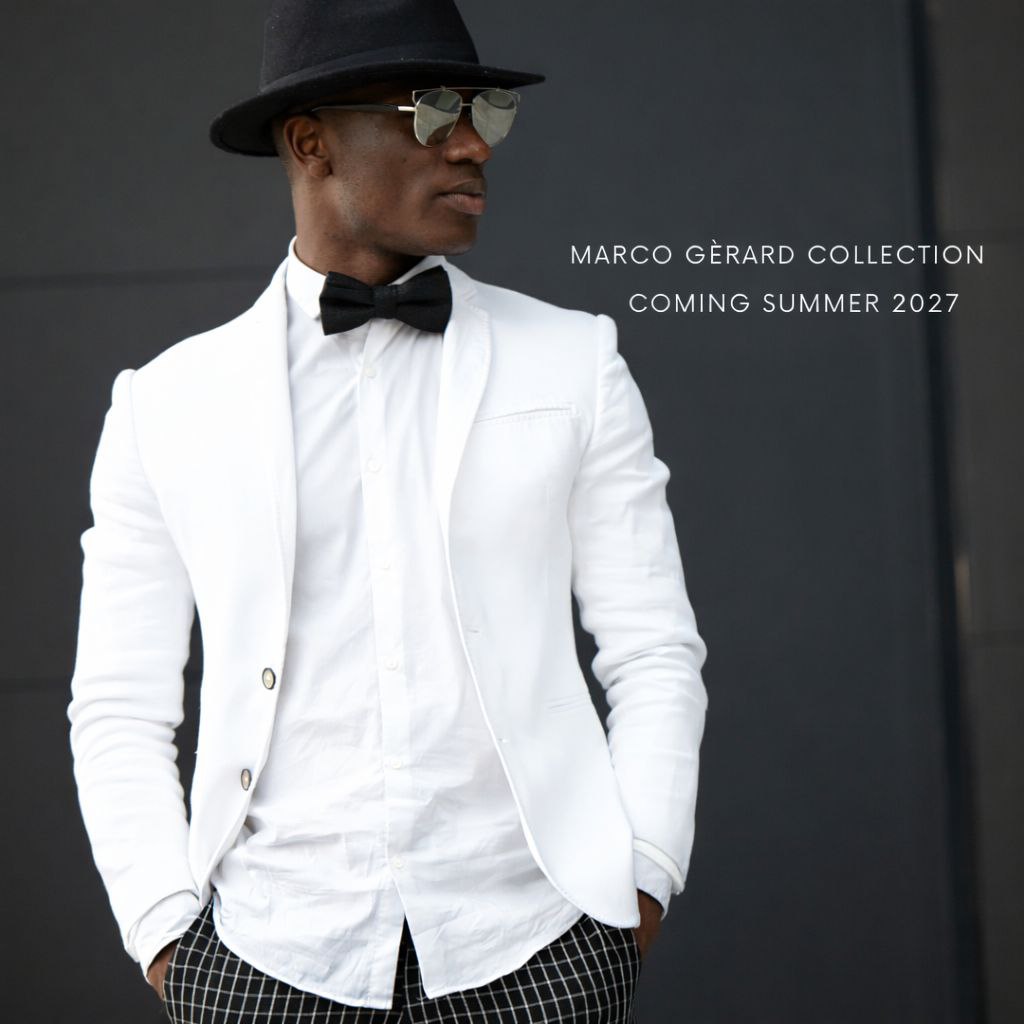

- Product lines in controlled pre-launch and limited release phases

- Registry infrastructure in place

- Private capital discussions by invitation only

Investment Philosophy

Marco Gérard seeks strategic, patient capital aligned with long-term brand stewardship—not short-term exits or growth-at-all-costs strategies.

Participation is limited.

Governance is intentional.

Expansion is disciplined.

This is not a consumer brand chasing volume.

This is a luxury house protecting legacy.

Private materials available upon request.

Founder discussions by invitation only.